How interest rates effect the stock prices and the crypto market? Here is the correlation between, from 2019 to 2022

How interest rates effect the stock prices and the crypto market? Here is the correlation between, from 2019 to 2022

While interest rates are changing too often due to multiple crises nowadays, I wanted to build an investment portfolio, and I thought conducting research on the relevance between common asset prices and interest rate changes would be helpful.

Disclaimer: The article you are about to read shows no real academic conclusion, and nothing should be affected by this article. These are my observations only.

Interest rates can have a significant effect on asset prices. In general, when interest rates are low, the prices of assets such as stocks and real estate tend to be high because they provide a relatively attractive return compared to other investments that have low interest rates, such as cash or bonds. On the other hand, when interest rates are high, the prices of assets such as stocks and real estate tend to be low because they provide a relatively low return compared to other investments that have high interest rates, such as bonds or certificates of deposit.

Another way that interest rates can affect asset prices is through their impact on the overall level of economic activity. When interest rates are low, borrowing costs are also low, which can stimulate economic growth and lead to higher asset prices. Conversely, when interest rates are high, borrowing costs are also high, which can dampen economic growth and lead to lower asset prices.

So, in a normal economy, higher interest rates mean lower financial asset prices like stocks, bonds, or cryptocurrencies*. There are a lot of articles about that, and some of them are really well supported. Here in this article, I will look into the Fed’s interest rate decisions, Turkey’s interest rate decisions, and the stock market price changes depending on those decisions.

Changes in interest rates can have an impact on the stock market, but the relationship between these two factors is complex and can vary depending on market conditions and other factors like:

- Corporate performance

- Economic conditions

- Interest rates

- Market sentiment

- Political issues And interest rates are really a big part of this, especially if the attention to the decision is bigger than normal. (The example is at *A). In this article, I am going to calculate correlations between common stocks and the interest rate changes.

Correlation is basically a statistical measure that expresses the extent to which two variables are linearly related. By calculating that value, we end up getting a result between 1 and -1. +1 means perfect positive correlation, and -1 means perfect negative correlation. So, anywhere between 1 and 0 means it is directly related, and anywhere between 0 and -1 means it is inversely related.

So, I collected the data for the assets listed below from January 1, 2019, to November 25, 2022:

- NASDAQ 100 (NDX)

- S&P 500 (SP500)

- DOW Jones (DJIA)

- Market Yield on U.S. Treasury Securities at 2-Year Constant Maturity (DGS2)

- Turkey’s 2-year Market bond yield for the interest rate (TR2YT)

- BIST 100 (XU100)

- Bitcoin (BTC)

Things are simple when the expectations match up with the decisions, like what the Fed is doing, but things get interesting when the decisions are not matching up with the expectations, like what the Turkish Central Bank is doing nowadays (2022).

Here are the results:

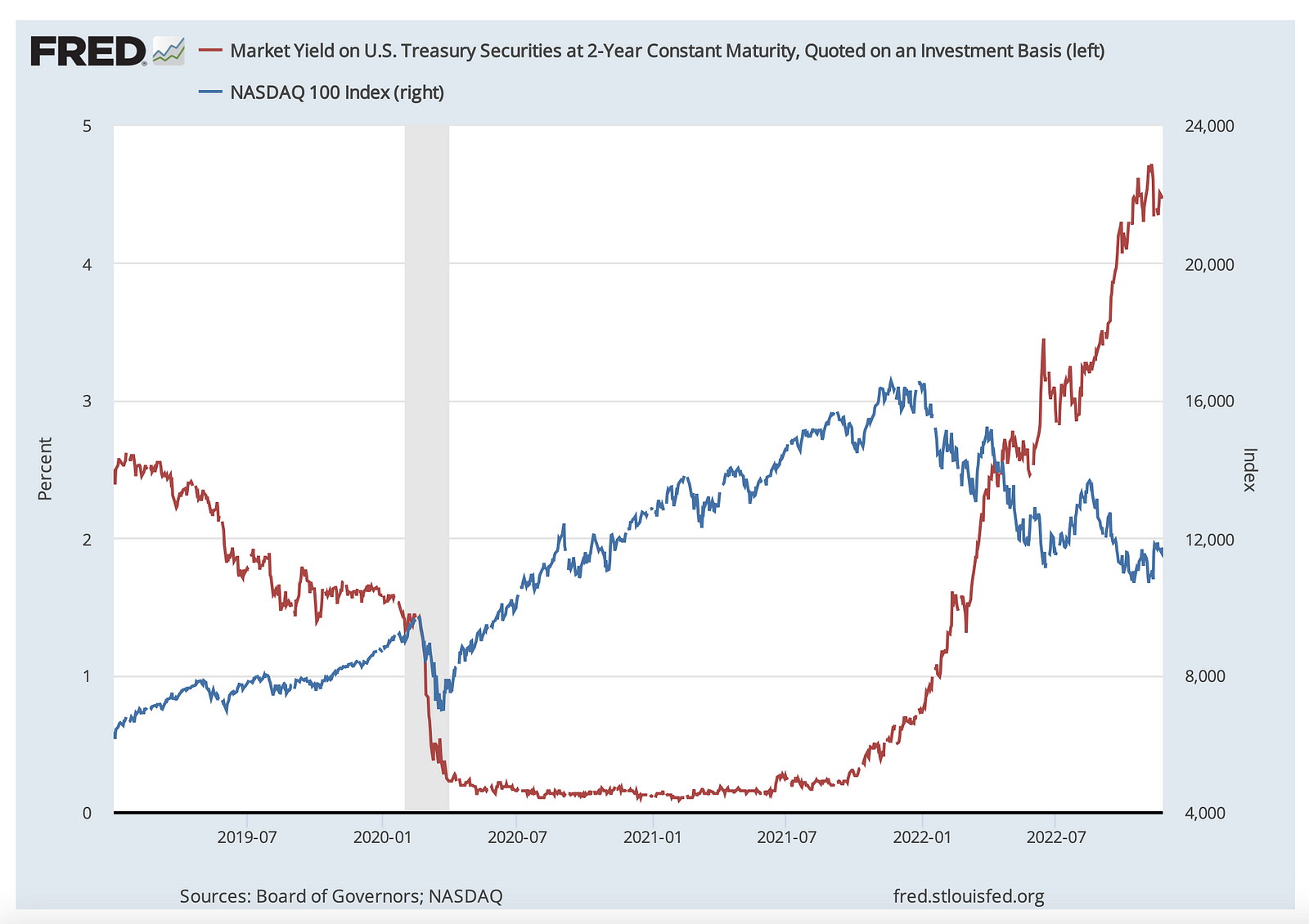

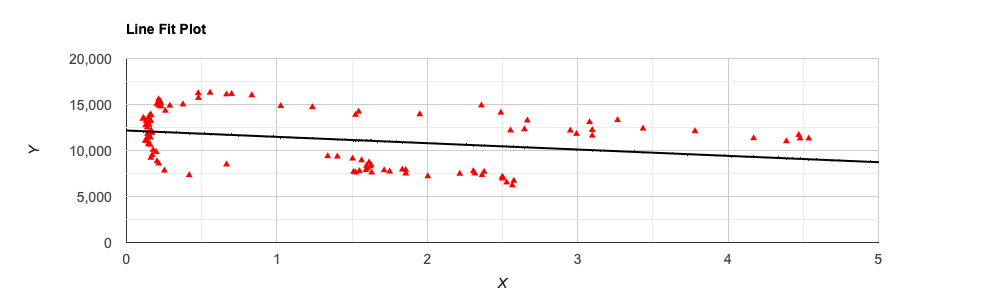

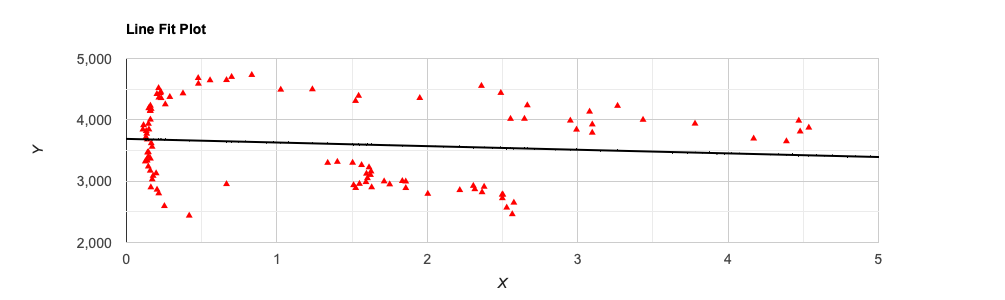

NASDAQ 100 vs DGS2 :

01.01.2019–11.25.2022

As we can see on the chart, we can assume that they have an inverse correlation.

NASDAQ 100 vs. DGS2 correlation is -0.2958, which supports that they are inversely proportional.

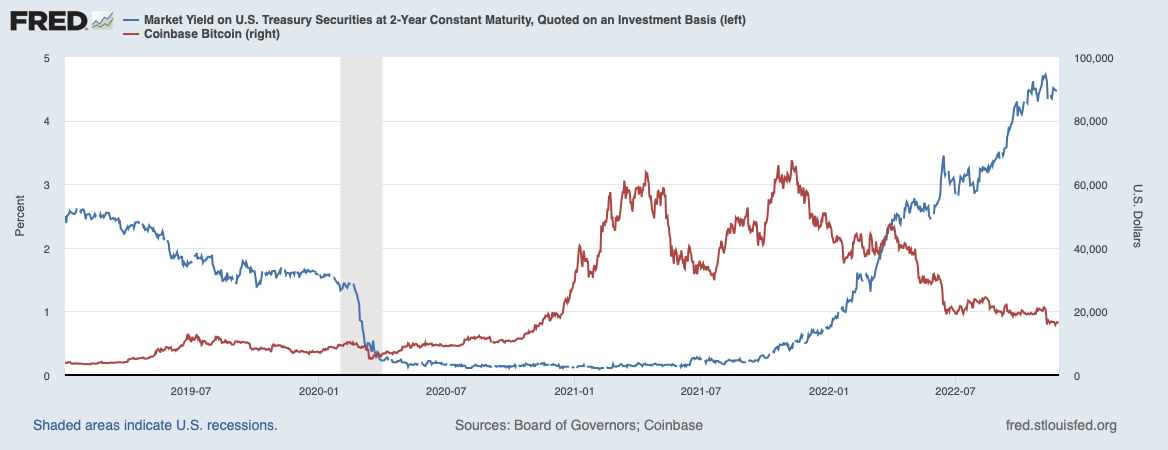

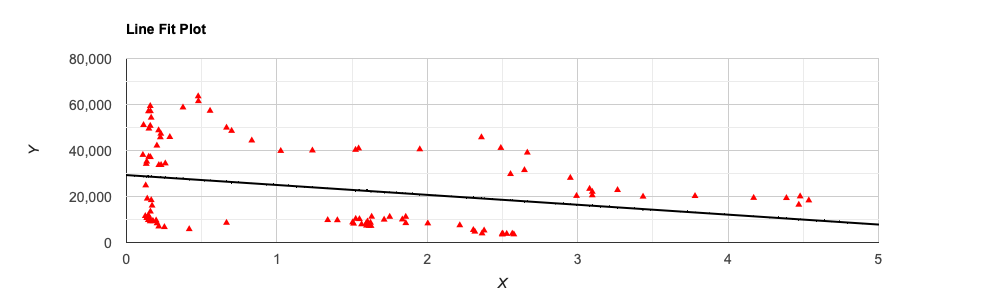

BTC vs DGS2

01.01.2019–11.25.2022

Another inverse correlation.

BTC vs. DGS2 correlation is -0.3028.

S&P 500 vs DGS2

01.01.2019 – 11.25.2022

Negative Related.

S&P 500 vs DGS2 correlation is -0.1144 not as strong as the others, but still.

Here’s the fun part,

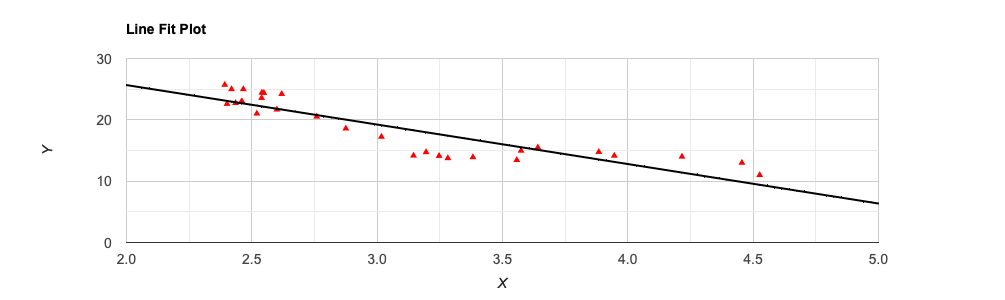

Turkiye’s Interest Rate vs BIST100:

BIST 100 vs. TR2YT correlation for 01.01.2019–11.25.2022 is -0.02718, which is a really low number which is not pretty usual.

As can be seen on the graph, the last 6 months seems like strongly inversely related. Is it?

- A: When we consider Turkey’s current status, for the last 6 months, the central bank of Turkey keeps decreasing the interest rate insistently even though inflation is above 80%, and most investors and economists tell the otherwise. That means there is more attention from everybody on the decision of the central bank than normal.

So I calculated the correlation between these specific dates

BIST100 vs TR2YT correlation for 05.06.2022–11.25.2022 is –0.8923 which is a really powerful number.

That shows us in certain times, interest rates may affect the asset prices more than the market expects. But we should always consider that there are a lot of other variables that affect the prices.

What about mortgages? Changes in interest rates can have an impact on mortgage rates, which can in turn affect the housing market and the broader economy. When the Federal Reserve, which is the central bank of the United States, raises interest rates, it becomes more expensive for banks to borrow money. As a result, banks may raise their own interest rates, including the rates they charge for mortgages. This can make it more expensive for consumers to borrow money to buy a home, which can in turn slow down the housing market.

When the Federal Reserve lowers interest rates, it becomes cheaper for banks to borrow money. This can encourage banks to lower their own interest rates, including mortgage rates. This can make it cheaper for consumers to borrow money to buy a home, which can in turn stimulate the housing market.

In the end, interest rates are not the major factor affecting most of the financial assets. But definitely, it has the potential to be that way in some specific circumstances.

*I am aware that cryptocurrencies are not considered financial assets but intangible. Or whatever you want to call them since they are still not regulated in a decent way.